How ESG Integration Enhances EHS Management and Business Sustainability

October 1, 2021

As businesses face growing pressure from investors and consumers to prioritize sustainability and ethical practices, ESG integration is becoming essential to advancing EHS programs. However, EHS professionals may find that their efforts naturally align with these principles.

What does one have to do with the other?

EHS has long been positioned as a cost-avoidance function to protect company profits through protection programming. But with growing interest by businesses and their efforts to align with ESG integration, the one will most definitely help the other.

“With ESG, there’s a triple bottom line: profit, people, and the planet that will be demanded not only by the internal stakeholder, but the consumer and those looking to invest as shareholders,” says Intelex Vice-President of Health and Safety, Scott Gaddis.

“As we advance, the ability to position EHS as a business partner with increased value for the ethical and moral view of EHS – and in support of ESG integration efforts – is a good thing.”

Get free-trial access to an ESG software solution

The Rise of ESG

ESG was first mentioned in the context of sustainable business practices in a 2006 United Nation’s report. It has evolved into the Principles for Responsible Investment (PRI) and is today a criterion used to measure sustainability and ethical impact of a business or company. Many ESG integration goals are covered and enforced by national laws and regulations in countries around the world, and ESG concerns have moved to the forefront of business planning and investor concerns.

Today’s investors are making bets on companies that are “good for the planet” and doing their part to protect people and the environment. Likewise, more and more consumers want to put their money and loyalty behind such brands.

Research shows nearly two-thirds (64 percent) of Americans say they would pay more for sustainable products and 78 percent of people are more likely to purchase a product that is clearly labeled as environmentally friendly. What’s more, 77 percent of Americans say they are concerned about the environmental impact of the products they buy.

Businesses, too, reap rewards by being ESG-responsible. According to management consultants McKinsey & Company, “ESG-oriented investing has experienced a meteoric rise—global sustainable investment now tops $30 trillion.”

The World Economic Forum (WEF) in January 2020 reported that, “according to a 2018 global survey by index provider FTSE Russell, more than half of global asset owners are currently implementing or evaluating ESG considerations in their investment strategy.”

The WEF also says that, in 2018, Bank of America Merrill Lynch found “firms with a better ESG record than their peers, produced higher three-year returns, were more likely to become high-quality stocks, and were less likely to have large price declines and go bankrupt.”

SDGs and ESG

Which brings us to the transformation vision of the 2030 Agenda for Sustainable Development – a document created in 2015 by the United Nations and signed by 193 countries. The 2030 Agenda outlines an aspirational commitment to formulate a road map for economic viability, environmental protection and social equity “for the planet and its people.”

It outlines 17 goals intended to create equitable, inclusive and peaceful societies and provide environmental protection for “life on land and below water.” For more information about the document and what it says, get the Intelex Insight Report: ESGs and Sustainable Value Creation.

Interconnecting and overlapping aims are divided across environmental, social and governance criteria. The 17 goals, characterized as Sustainable Development Guidelines or SDGs, break down into:

- Environmental criteria that consider a business’s efforts to protect and preserve natural environments. It focuses on minimizing waste and pollution, resource depletion, greenhouse gas emissions, deforestation and climate change.

- Social criteria that look at how a company treats people and considers employee relations and diversity, working conditions, local community, health and safety, and conflict.

- Governance criteria that examine how a corporation polices and oversees itself. It focuses on tax strategies, executive salaries, donations and political lobbying, corruption and bribery, plus board diversity and structure.

The Intersection of ESG and EHS

“Our world, the work world, and the essential role of safety and health (S&H) professionals have radically changed due to the global COVID-19 pandemic,” says Kathy Seabrook of Global Solutions Inc. in her recent blog – True North…Are You Future Fit?

“For many of us, this shift has opened welcome opportunities to spotlight the importance of workplace safety and health,” she says. “But the wider business world was shifting before the crisis hit, with significant implications for business, its people, stakeholders and safety and health professionals. Simply put, today’s companies depend more and more on their workforce – an organization’s human capital – to create value.”

No doubt most EHS professionals would rightly declare the work they’ve been doing has aligned with many ESG principles all along. However, Gaddis notes that some in senior business leadership were too often not interested in EHS concerns unless there was a significant miss in compliance and targets, and they typically only looked at a few metrics to measure success. The outline of ESG gives EHS practitioners a platform to be a business partner that’s not simply judged from a cost avoidance function, but as a real partner in the business.

“Their work affects the non-financial impacts investors and shareholders are beginning to demand and an ethical approach to managing businesses,” he says.

Gaddis says there’s a solid intersection within “governance” in procuring materials and managing risk. He notes that, for EHS professionals, their deep expertise in managing risk will be a skill relied upon by organizations for ESG integration programs. In his recent article, KPMG India Manager Phani Prasad M. noted, “In its essence, EHS is more a subset of ESG as ‘E’ is a common aspect while Occupational Health and Employee Safety together with CSR (corporate social responsibility) comprise the ‘S’ aspect of ESG.”

Within the three ESG broad pillars, much of “environmental” is already well reported to shareholders through EHS efforts. These generally have included greenhouse gas, energy and water conservation, wastewater, waste and water management, pollution, and compliance. Other areas, possibly new to some in EHS, will have an increased focus. In the area of “social,” expect to see emphasis placed on chemical, biological and radiological impacts on people who work in communities with established businesses.

Gaddis says there’s a solid intersection within “governance” in procuring materials and managing risk. He notes that, for EHS professionals, their deep expertise in managing risk will be a skill relied upon by organizations for ESG integration programs.

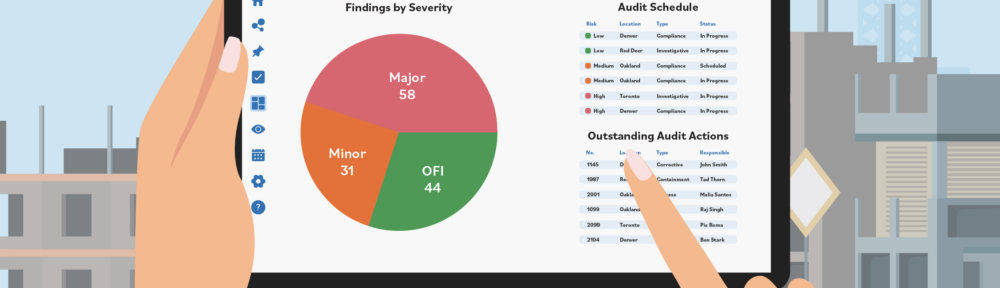

Chris Ward, a former regulator and principal health and safety inspector in the United Kingdom who is also a member of the British Standards Institute committee, says EHS processes provide data for disclosure in ESG operations reporting

“Through the implementation of and adherence to international standards in relation to these areas (of environment, social and governance) – for example ISO 14001 Environmental, ISO 45001 Occupational Health and Safety and ISO 45003:2021 Psychosocial Risks – EHS practitioners can demonstrate ongoing processes of continual improvement in these areas,” he says. “Also, by ensuring their procurement and supply chains are in conformity with these standards, investors will be reassured of the sustainability, conformity and continuity of these policies throughout an organization’s areas of operation.”

ESG Integration Is Here To Stay

Ward says ESG integration has changed the perception of EHS.

“There can now be quantifiable, recorded data, which can be used to assess and analyze material risks and growth opportunities,” he says. “This informs investment judgements based, not merely on financial considerations, but on embracing the goals set out in the Paris Agreement. These non-financial considerations are delivered by EHS.”

ESG is well beyond a lofty ideal and is gaining regulatory traction. The European Union (EU) currently leads the way in giving ESG some bite through the Sustainable Finance Disclosure Regulation (SFDR), which came into effect in March, and designed to drive capital toward sustainably-oriented investments. It is widely considered the broadest regulatory action in sustainable finance to date. For firms in the United States trying to keep up with the blistering pace of ESG-related transformations within the financial sector, the SFDR may offer clarity.

The SFDR was initiated by the European Commission as part of a broad EU action plan, announced in 2018, to encourage sustainable investing throughout the EU financial system and to put ESG issues on-par with traditional financial risk indicators. It is broad in scope, covering nearly all asset managers, investment product providers, and financial advisors that operate within the EU. The first phase of reporting standards is already in effect and increasingly detailed reporting obligations will phase in over the coming months and years.

In the United States, the Biden Plan for a Clean Energy Revolution and Environment Justice Plan is looming as an important ESG catalyst for that country. It reflects acceptance of the belief that climate change poses an “existential threat to the environment, people’s health, communities, national security and the economic well-being of the nation.” Based on the imperative to address these issues is the need to embrace a greater ambition to meet the scale of the challenge and to understand that the environment and the economy are “completely connected.”

It features a five-point plan that is overarching with generalities, but not yet fleshed out with detail of required federal legislation needed to deliver it. Proposals include:

- Establishing an enforcement mechanism to achieve milestone targets no later than 2025

- Making historic investments in clean energy and climate research and innovation

- Creating incentives for the rapid deployment and development of clean energy innovations nationwide with special emphasis on those areas most impacted by climate change

To increase the strength and resilience of the country’s national infrastructure against impacts of climate change, The Biden Plan proposes building new stronger roads, bridges plus electric and water infrastructures designed to:

- Withstand the pressures of those organizations that are the principal environmental polluters, and which disproportionately affect low-income communities, and,

- Meet historic obligation to peoples and communities that have contributed to the generation of wealth and growth for the nation through industrialization.

These objectives are clearly based on the SDGs of the earlier mentioned 2030 Agenda for Sustainable Development. However, to achieve these laudable aims, the thinking is that a stick-and-carrot approach of rewards and incentives will need to accompany policy changes. Also, the financing for these schemes will require private investment and corporate backing.

Looking Ahead

The future no doubt sees more being demanded of businesses to do their part for the good of the planet. And woe to those that make less than a sincere effort. A Harvard Business Review article from March condemned self-serving companies that make hollow commitments or overpromise transformation, arguing such behavior “undermines real work being done by others.

“Companies should be required to publicly report on their social and environmental impact with clear, standardized, easy-to-understand metrics, such as carbon emissions, investments in training programs and proportion of workers earning a living wage,” the article reads.

Expectations have changed. Investors and consumers want to see much more corporate action taken to help the planet and people by those with whom they do business. That’s great news for everyone.