Understanding ESG Materiality: From Definition to Implementation

July 24, 2023

Materiality is an important concept in ESG. However, many organizations struggle to understand what it means, how it relates to their business and how to act on it. This article will look at what materiality is and what you need to do to incorporate it into your ESG Strategy.

Highlights

What is ESG Materiality?

What Are the Different Types of Materiality?

What Are the Common Material Topics in Different Industries?

Is Materiality the Same in Different Industries?

Are Materiality Assessments Mandatory?

How Does a Materiality Assessment Benefit Decision Making?

How Do I Conduct a Materiality Assessment?

How Can Technology Help with Materiality?

Conclusion

What is ESG Materiality?

In the last few years, ESG has moved from a nice-to-have element of CSR (Corporate Social Responsibility) programs to a critical component of corporate strategy. With mandatory requirements from the SEC (Securities and Exchange Commission) in the United States and CSRD (Corporate Sustainability Reporting Directive) in the EU either upcoming or currently in force, organizations around the world should be thinking about how to facilitate collecting, managing and reporting ESG data.

Assessing ESG materiality means learning how ESG-related risks impact your organization and how your organization impacts your internal and external stakeholders. When you measure materiality, you are identifying the unique ESG risks in your organization and prioritizing them to ensure you provide budget and resources to address them. Identifying these issues is important for understanding how ESG risks can impact your organization’s strategy, performance and brand.

Some definitions from different sources highlight the complexity of the concept of materiality.

United States Securities and Exchange Commission

“How any climate-related risks identified by the registrant have had or are likely to have a material impact on its business and consolidated financial statements, which may manifest over the short-, medium-, or long-term.”

International Sustainability Standards Board (ISSB)

“Sustainability-related financial information is material if omitting, misstating or obscuring that information could reasonably be expected to influence decisions that the primary users of general-purpose financial reporting make on the basis of that reporting, which provides information about a specific reporting entity.”

Global Reporting Initiative (GRI)

“Material topics are topics that represent an organization’s most significant impacts on the economy, environment, and people, including impacts on their human rights.”

European Financial Reporting Advisory Group (EFRAG)

“A Sustainability matter is material from an impact perspective when it pertains to the undertaking’s material actual or potential, positive or negative impacts on people or the environment over the short-, medium-, and long-term time horizons.”

What Are the Different Types of Materiality?

There are a number of different types of materiality.

Dynamic Materiality recognizes that material concerns can change over time and that risks that are immaterial today could be considered material tomorrow. Changes that impact materiality include the introduction of new regulations, increased public demand for ESG accountability, legal actions or the introduction of new reporting frameworks.

Financial Materiality refers to ESG issues that impact an organization’s ability to generate cashflow. This is sometimes referred to as outside-in, meaning it’s primarily related to the impact of the environment on the business.

Impact Materiality is the impact the organization has on the community and environment in which it operates. This is sometimes referred to as inside-out.

Double Materiality is an approach that includes both financial and impact materiality. It is a holistic consideration of the impact of environmental risk on the organization and the impact of the organization on the environment. Double materiality assessments are mandatory under the EU Sustainability Reporting Standards (ESRS) from EFRAG, which is the framework used for CSRD.

What Are the Common Material Topics in Different Industries?

The Sustainability Accounting Standards Board (SASB) provides a Materiality Finder that can help organizations in different industries better understand what their material concerns are most likely to be. SASB identifies the following six environmental topics that are common across most industries:

- GHG Emissions

- Air Quality

- Energy Management

- Water and Wastewater Management

- Waste and Hazardous Materials Management

- Ecological Impacts

Is Materiality the Same in Different Industries?

Every industry will have different materiality priorities depending on their production methods and geographic location. Not all of the six topics identified by SASB will be considered material in every industry.

It is important to remember that the principle of Dynamic Materiality means these materiality priorities are not necessarily permanent. Over time, industries could find topics that were previously not considered material are now material, which would require revising the materiality assessment before the next reporting period.

Are Materiality Assessments Mandatory?

Materiality assessments are considered mandatory under most reporting frameworks, but there are some significant differences depending on where your organization operates.

In the United States, the SEC has adopted a definition of materiality that is more in line with the concept of financial materiality defined by ISSB. This outside-in definition is more likely to gain acceptance in the US market, which is the site of considerable political conflict over the application and implications of ESG frameworks.

In the EU, double materiality assessments are mandatory under CSRD, which means over 50,000 companies in the EU, as well as many more non-EU organizations that operate in or have supply chain connections in the EU, will be obligated to submit them in upcoming reporting periods.

The discrepancy between the application of financial and double materiality in different regions will be a continued source of confusion and frustration for organizations, many of which are already trying to navigate the multiple reporting frameworks they might be required to use. US organizations adopting ISSB standards will potentially have difficulty conducting business or engaging in acquisitions with EU organizations adhering to ESRS standards under CSRD. While ISSB recognizes the validity and importance of impact materiality, it does not make it mandatory for US organizations, which means there will continue to be a divide between EU and US approaches to ESG reporting.

How Does a Materiality Assessment Benefit Decision Making?

A materiality assessment is essentially a form of risk assessment about specific ESG topics. When an organization conducts a materiality assessment, it is measuring the opportunities and threats that environmental topics present to the company, as well as those the company presents to the environment.

Like any risk mitigation exercise, a materiality assessment will help organizations prioritize threats and opportunities to ensure there are sufficient resources to address them. When the materiality assessment is done effectively and communicated to leadership, it should facilitate strategic alignment on ESG priorities and obligations, regulatory compliance, brand credibility and investor confidence.

How Do I Conduct a Materiality Assessment?

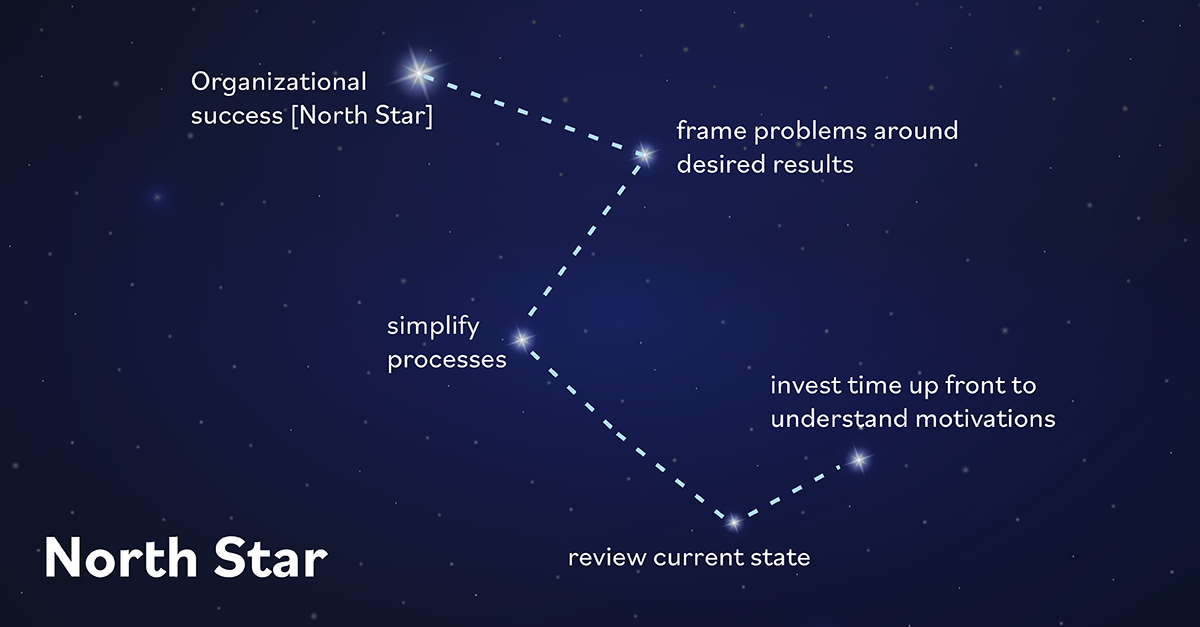

Conducting a materiality assessment should be a cross-functional project that includes input from all departments including sustainability, strategy, leadership, finance, legal and more. Organizations should ensure their materiality assessments are dynamic by refreshing their approach before every reporting period or at least every two years.

Table 2 shows a general approach to conducting a materiality assessment. It uses the PDCA (plan-do-check-act) approach to categorize the steps in a cycle of continuous improvement, which will be useful for revising the assessment before each reporting period.

How Can Technology Help with Materiality?

ESG is a data-intensive discipline. That means digital solutions are a critical component of effective materiality assessments and regulatory reporting. According to EFRAG: “Data technology has the potential to play a significant role in minimizing the reporting burden such as managing data collection, dissemination, and verification, applying science-based targets, and enhancing and enabling the qualitative characteristics that define good disclosures.”

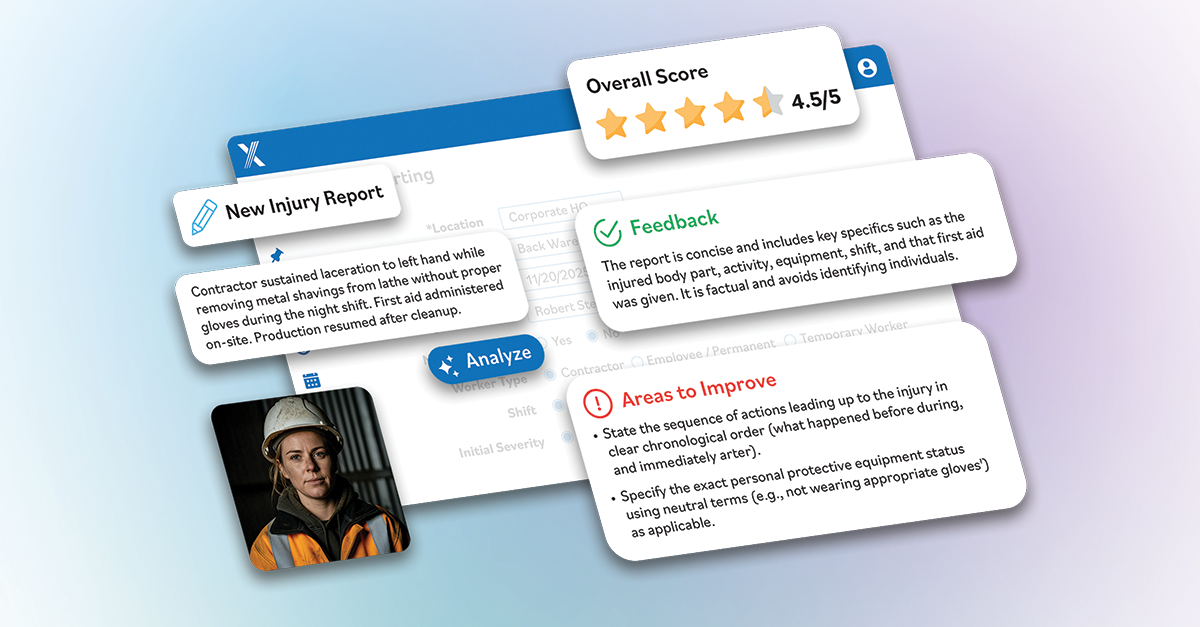

Intelex was ranked as a leader in ESG materiality assessments in a recent publication from an industry analyst firm. Intelex has an exclusive partnership with Datamaran, an automated solution that uses patented AI technology to identify and monitor over 400 external risk factors—including ESG, innovation, technology and geopolitical issues—on an ongoing basis by scanning the regulatory, media and corporate disclosures environments. By integrating Datamaran with Intelex’s leading ESG reporting solutions, customers can produce dynamic double materiality assessments that inform their ESG strategy, ensure regulatory compliance and promote the principles of sustainable business.

Conclusion

It is important to remember that materiality assessments are not checklists or one-and-done activities. They must be integrated into the risk-based thinking and continuous improvement activities of the entire organization. This means incorporating regulatory and market developments as they happen, as well as continuously scanning the marketplace for signs of potential changes and adjusting your materiality assessments to anticipate them. As ESG continues to develop and impose more demanding obligations on organizations, it will be critical to maintain a dynamic approach to materiality and to have the data management tools to support it.

Take your ESG strategy to the next level by booking a meeting with our experts. Learn how our solutions can help you implement effective ESG materiality assessments.