How Intelex’s New ESG Product Experience Can Help Reduce Your ESG Data Complexity

June 12, 2023

Just a few years ago, ESG (Environmental, Social and Governance) was more an aspirational goal than it was a source of risk or strategic concern. Many organizations would issue sustainability reports to let the market know they took concerns about climate change and the environment seriously. Others would submit environmental data to voluntary frameworks to improve their brand and benchmark their CSR (Corporate Social Responsibility) efforts against their competitors.

Today, the world is very different. ESG has quickly moved from marketing campaigns to a serious legislative and regulatory obligation with significant consequences for corporate reporting and data management. Two recent developments demonstrate the serious nature of these obligations.

The Corporate Sustainability Reporting Directive (CSRD) came into force in January 2023. While the EU (European Union) is the primary focus of the directive, any global organization that operates in the EU or has a supply chain that includes the EU could be subject to its obligations. CSRD provides strict guidelines on the environmental data organizations need to report. It also includes the requirement that organizations audit any sustainability information they report.

In the United States, the SEC (Securities and Exchange Commission) has proposed rule changes for climate-related disclosures that would significantly expand the information organizations need to disclose, including governance and management of climate-related risks, disclosures on climate-related metrics in notes to audited financial statements and GHG (greenhouse gas) emissions. Most importantly, these disclosures would now apply to emissions belonging to Scope 1 (emissions resulting from direct operations), Scope 2 (emissions created indirectly as a result of purchased energy) and Scope 3 (emissions further down the supply chain, such as those generated by suppliers or from use and disposal of the organization’s products). With a finalized rule expected in September 2023, organizations like the SEC are making ESG issues a critical concern for every organization today.

How ESG Reporting Software From Intelex Meets This Challenge

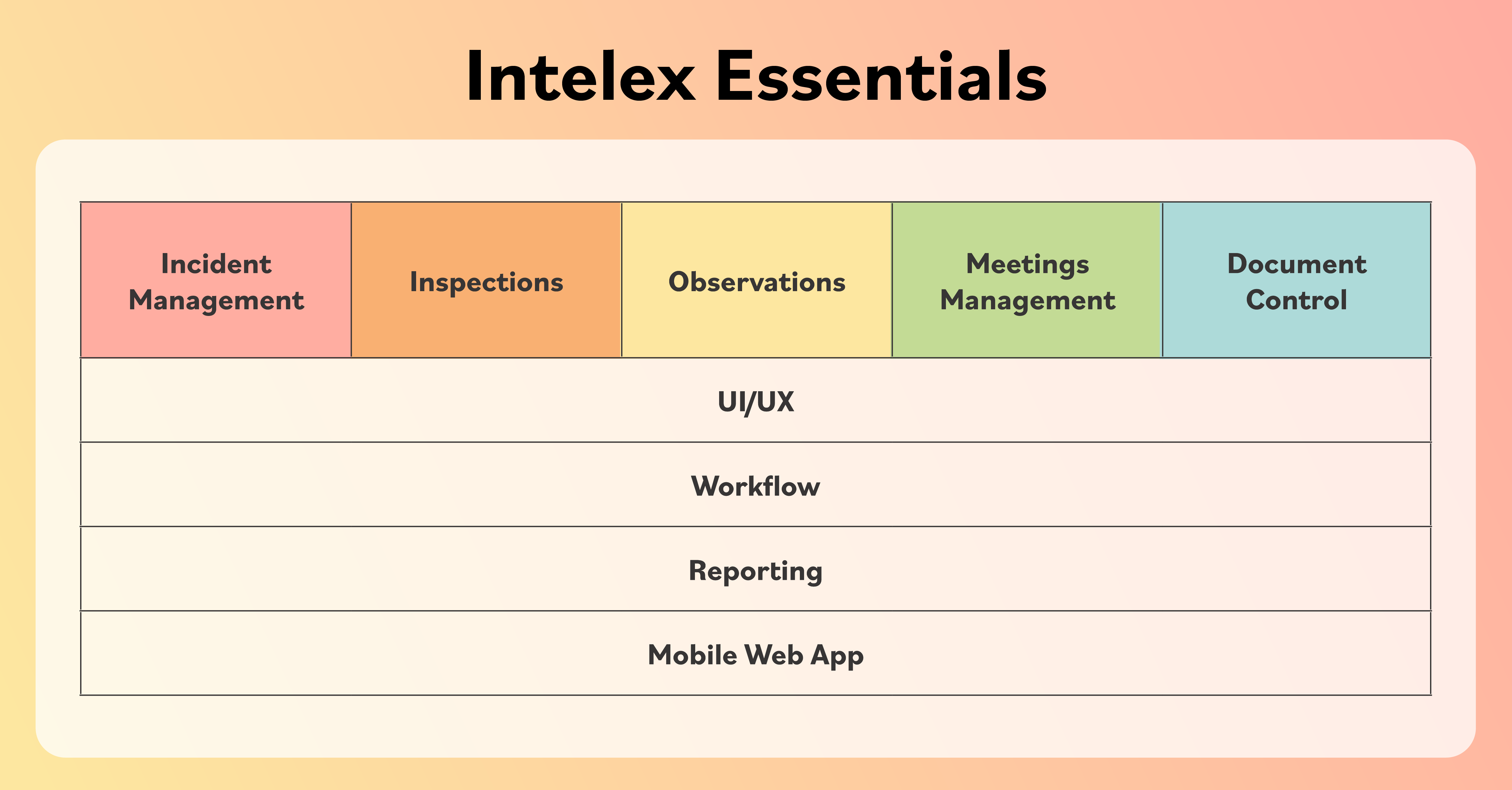

Intelex is introducing an all-new ESG product experience to build on the foundation of its existing ESG applications. The new Corporate Reporting for ESG application can help organizations meet the challenge of today’s ESG reporting requirements and be proactive in preparing for future market and regulatory developments. It is designed to provide out-of-the-box functionality to organizations that are struggling under the burden of collecting, analyzing and reporting the massive amounts of ESG data required to fulfill their regulatory obligations.

To learn more about Corporate Reporting for ESG, visit our product page.

ESG Corporate Reporting supports organizations in three ways.

Performance

Many organizations lack ESG expertise. While health and safety practitioners are helping to meet the demand for ESG data, the cross-functional nature of ESG data collection means many departments are often too disconnected and lack the skills to effectively manage ESG reporting. Corporate Reporting for ESG can help organizations have access to the expertise they need while facilitating integration of data from different departments. Users get guided online assistance within the application, as well as access to consultants who can provide guidance as required. Corporate Reporting for ESG uses dashboards and reports configured according to industry best practices to help organizations understand ESG trends and facilitate continuous ESG performance improvement. It allows workers to enter data on a mobile device from any location, which helps to ensure the management system has real-time data to engage corrective actions immediately.

Reporting

With obligations like CSRD or the SEC rules either in force or on the way, organizations need to have complete control over their reportable and auditable ESG data. However, as with any data project, the amount of data necessary for effective reporting can be substantial, which can lead to an extremely difficult workload for everyone in the organization. Further, a lack of data governance standards means much of the data organizations do have sits isolated or in data swamps, quickly becoming outdated or inconsistent over time. Data quality is a critical component of ensuring an effective ESG reporting program.

Intelex’s ESG reporting software can help address these problems. It provides structured forms for reporting to frameworks like CSRD, GRI, CDP and many others, as well as historical and real-time data analysis to ensure structured data is available for responding to any regulatory requirements or developments. Pre-defined forms and built-in data validation can ensure data quality by triggering escalations for missing data to ensure compliance with global ESG regulations.

Corporate Reporting for ESG schedules automated ESG data collection according to any timeframe the organization requires, while embedded analytic applications and a patent-pending calculation engine ensure all ESG data is captured, stored and analyzed for easy regulatory reporting.

Risk

ESG is changing the way the world thinks about risk. While traditional risk mitigation techniques rely on being able to predict with reasonable certainty what threats and opportunities will present themselves in the near future, ESG risks will play out over the next several decades. From climate-induced weather disasters to supply chain disruption, many of the threats and opportunities resulting from ESG are almost impossible to predict from our current position.

Intelex’s ESG reporting software helps organizations embrace a new way of thinking about ESG risk. It can trigger inspections and audits on emissions data based on regulatory thresholds to engage corrective actions before organizations become liable for violations. It also includes a comprehensive library of more than 40,000 emission factors needed for global reporting.

In partnership with Datamaran, Intelex’s ESG reporting software can identify and monitor over 400 external risk factors, such as ESG innovation and geopolitical issues, by continuously monitoring regulatory, media and corporate disclosure environments. This allows organizations to determine the materiality of their various ESG elements across the organization and to measure their impact on the environment in which they operate.

Conclusion

ESG reporting is not going to get easier over time. Organizations that rely on the traditional ways of managing ESG data are likely to find the burden of doing so quickly becomes overwhelming, draining resources and increasing the threat of regulatory action resulting from mismanaged data and ineffective reporting. Intelex’s Corporate Reporting for ESG application can help organizations tame the complexity of ESG reporting, freeing up resources for innovation and helping to ensure a sustainable world for future generations.

See our ESG Management Software in action – watch the demo now and discover how it can simplify your ESG reporting and improve sustainability initiatives.