What Data is Critical for ESG Management and Reporting?

September 8, 2022

Environmental, social and corporate governance (ESG) is an approach that allows organizations to measure their contributions to sustainability and ethical practices in a way that provides transparency to the market, financial benefits to the organization and benchmarking for industry. It is a response to increasing calls around the world for organizations to play a more significant role in creating a sustainable future while maintaining ethical behavior and contributing to the communities in which they operate.

ESG is an implementation of the aspirations of the United Nations’ 2030 Agenda for Sustainable Development, which contains 17 sustainable development goals (SDGs) according to the following categories, as shown in Table 1.

| Environmental | Social | Governance |

| 1. No Poverty | 6. Clean Water and Sanitation | 12. Responsible Consumption and Production |

| 2. Zero Hunger | 7. Affordable Clean Energy | 13. Climate Action |

| 3. Good Health and Well-Being | 8. Decent Work and Economic Growth (Promote Safe and Secure Working) | 14. Life Below Water |

| 4. Quality Education | 9. Industry and Innovation and Infrastructure | 15. Life on Land |

| 5. Gender Equality | 10. Reduced Inequalities | 16. Peace, Justice and Strong Institution |

| 6. Clean Water and Sanitation | 11. Sustainable Cities and Communities 12. Responsible Consumption and Production | 17. Partnership for the Goals |

The Importance of ESG Data Management

ESG management is about more than simply good intentions and strong marketing campaigns. Instead, data collection, analysis and reporting are the most important components of a strong ESG management program. ESG efforts must be quantifiable, measurable and strategic, not simply aspirational talking points.

However, not all data are good data. In the rush to be part of the data and analytics revolution, many organizations haphazardly collect data without distinguishing between high-quality data and low-quality data. Data quality refers to whether or not the data are fit for purpose and meet the requirements for analysis. Poor quality data result from such things as errors in manual entry, inefficient processes, aging data that becomes irrelevant, lack of common data standards and poor data governance. Poor quality data can have significant negative impacts on the credibility of ESG initiatives, including poor ratings from ESG ratings agencies, negative brand impact and increased organizational risk (Mahanti, 2018). Table 2 shows some of the most common and important dimensions of data quality.

| Dimension | Definition |

| Completeness | The measure of whether or not data are present. |

| Accuracy | The data reflects reality. |

| Validity | The data comply with standards, guidelines or definitions. |

| Uniqueness | There are no duplicate records for the same entity or event. |

| Consistency | Presentation of data is consistent across the data set. |

| Timeliness | Data are available when expected and needed. |

ESG Data Metrics and Disclosures

In January 2020, the International Business Council (IBC), an organization within the World Economic Forum, launched an initiative to define common metrics for ESG reporting. The goal of this project was to ensure that organizations have a clear and consistent approach to measuring their ESG initiatives and providing value to stakeholders along the entire value chain.

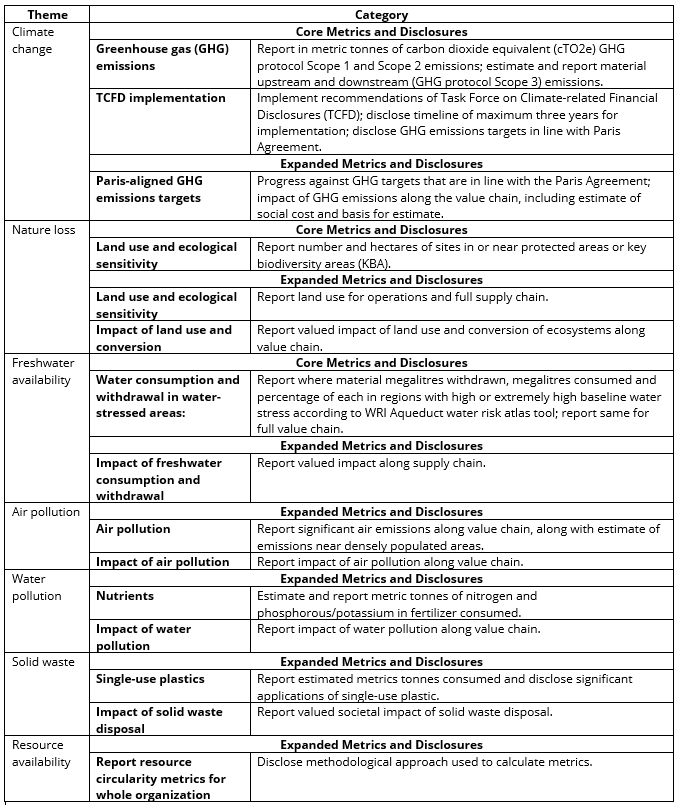

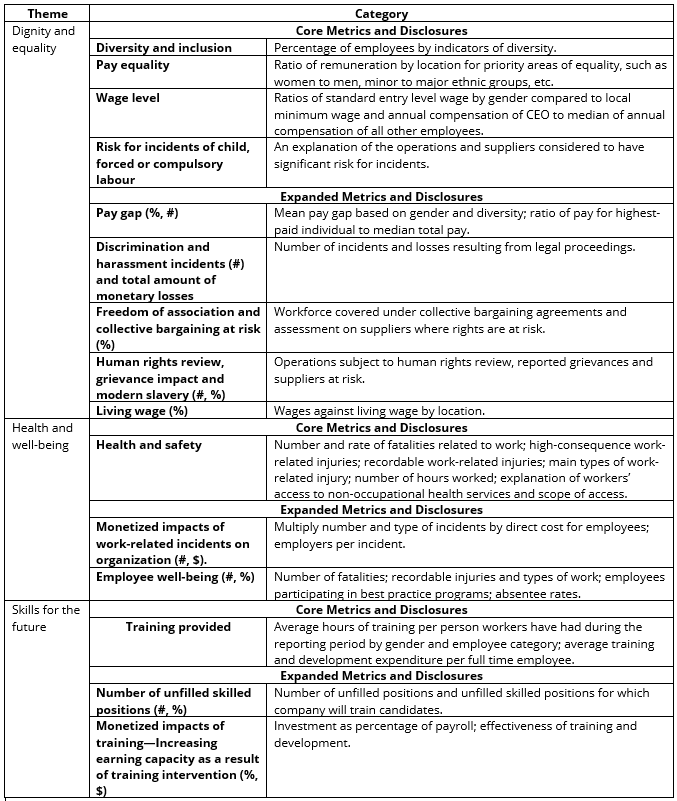

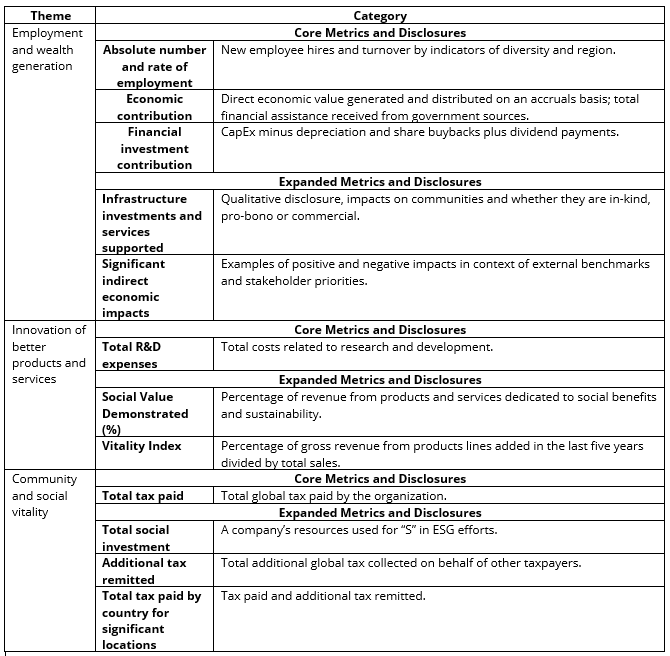

IBC created a set of core and expanded Stakeholder Capitalism Metrics that align with the United Nations’ Sustainable Development Goals. The 21 core metrics focus on internal activities that are probably already being collected by many organizations. The 34 expanded metrics are less likely to be collected at present and extend along the entire value chain. Together, these metrics can help organizations better understand how to determine the shape and scope of their ESG management initiatives.

Below is a summary of the Stakeholder Capitalism Metrics as determined by IBC.

Pillar I: Principles of Governance

Pillar II: Planet

Pillar III: People

Pillar IV: Prosperity

ESG Reporting Software for Collecting and Managing ESG Data

ESG management is based on the principle that organizations must consider non-financial elements when measuring material risks and opportunities. While ESG reporting software for measuring internal ESG data within the organization will continue to be critical, new AI-based applications are providing innovative approaches to monitoring the external landscape to improve risk management, annual reporting and Board oversight.

Intelex is a cloud-based, software-as-a-service (SaaS) platform that allows organizations to monitor, measure and improve EHSQ processes. Integrated management systems for EHSQ built on Intelex can use applications like Assets and Compliance Tracking System (ACTS) and ESG Management to collect data on air, water and waste and to report on sustainability initiatives across the organization, while other applications for health, safety and quality can support such critical activities as leading and lagging indicators, supply chain management, risk and nonconformances. As a result, organizations can reduce risk and ensure compliance for all of their EHSQ obligations while fulfilling their obligations to ESG reporting.

Before Intelex can measure and improve internal processes, the organization must determine its obligations, risks and opportunities by understanding key competitive, regulatory and reputational drivers. While this has previously proven overwhelming for many organizations, artificial intelligence (AI) applications are helping to make this a more common reality. Intelex uses ehsAI and Datamaran to augment its AI capabilities and put more analytic power in the hands of organizational leadership.

Datamaran is the only automated solution available to achieve a data-driven business process for external risk and materiality analysis. Using patented technology, it identifies and monitors over 400 external risk factors—including ESG, innovation, technology and geopolitical issues—on an ongoing basis by scanning the regulatory, media and corporate disclosures environments. Senior management of global companies use Datamaran’s evidence-based approach to communicate timely and relevant information to the board of directors, move materiality from an operational exercise to a strategic process and monitor emerging trends.

Together, Intelex, ehsAI and Datamaran give organizations the software they need to support ESG reporting and contribute to a more sustainable future for the global community.

Discover how Intelex ESG Management and Reporting Software can streamline your ESG data and drive sustainable impact. Click to learn more.