The Future of ESG Readiness: How To Use Technology for Strategy and Goal Setting Beyond Compliance

April 12, 2022

Not long ago, the way businesses interacted with the market was based on simple supply and demand: businesses offered goods and services, customers bought them and the system worked more-or-less as designed. Considerations of environmental impact, social justice and principled governance were important, but because they weren’t standardized or enforced according to any universal benchmarks, they often existed in the more erudite realm of ethics or Corporate Social Responsibility (CSR), and environment, society and corporate (ESG) compliance seemed far away from reality.

Jump ahead a few years to the present day and you’ll see that considerations regarding ESG have changed, and so have the ways we think about risk, stakeholder engagement and materiality. ESG has given consumers and investors the tools to ensure organizations are abiding by the principles and values that are increasingly critical to twenty-first century society, such as sustainability, equity of outcome and transparent governance.

As regulators increasingly adopt ESG principles and frameworks to hold organizations to account, the compliance burden in those organizations grows heavier and more complex. Collecting and analyzing real-time, external data and monitoring dynamic market developments are crucial for organizations to innovate and thrive. Together, Intelex and Datamaran are helping organizations take a more rigorous approach to ESG data collection and ESG strategy, including through data-driven materiality risk management and board oversight.

Understanding the ESG Regulatory Landscape

There is no shortage of voluntary disclosure frameworks organizations can use to manage their ESG considerations. The goals from the 2021 COP26 conference—global net zero by 2030, protecting communities and habitats, mobilizing finance and working together to deliver—are important developments for articulating the path to sustainability by mid-century, but the commitments are voluntary. Many organizations will adopt these goals, or other voluntary frameworks from bodies like the International Sustainability Standards Board (ISSB) to inform their ESG efforts, but not everyone will, creating a division between those that make real commitments and those whose prevarication will endanger the efforts to create a more sustainable world for future generations.

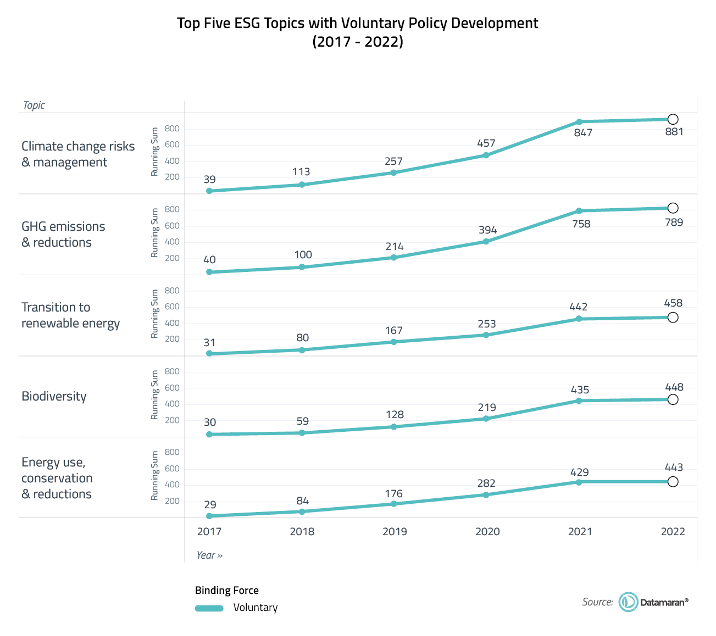

With growing interest from investors, regulators, corporations and the general public, voluntary initiatives have increasingly tended to convert into mandatory ones. The case of climate regulations such as the new SEC proposal, built on the efforts of soft norms and voluntary initiatives such as the TCFD, is just the latest example. As Datamaran (an Intelex partner) data show, there is a wide variety of ESG issues receiving regulatory attention in recent years. Those companies whose intent is to neglect such initiatives will find themselves exposed to regulatory, competitive and reputational risks.

A Shift from Voluntary Initiatives to Hard Laws

There is a steady increase in the use of mandatory requirements in many jurisdictions. Such requirements, including the EU Taxonomy Regulation and the Enhancement and Standardization of Climate-Related Disclosures for Investors from the SEC, are holding organizations to a high standard for ESG disclosure. The SEC requirements, in particular, contain significant obligations for organizations to disclose the full range of environmental emissions, including Scope 1 (emissions resulting from direct operations), Scope 2 (emissions created indirectly as a result of purchased energy) and Scope 3 (emissions further down the supply chain, such as those generated by suppliers or from use and disposal of the organization’s products).

These requirements are about much more than reporting omissions. Instead, they require organizations to understand their impact on the overall business strategy. As a result, robust data collection processes will be a critical component of the way organizations meet these risks. The SEC proposals require that organizations provide the following climate-related information in their reporting:

- Risks related to climate and their potential material impacts on strategy, business model and outlook.

- Governance and management of climate-related risks, such as severe weather events and the cost of transition to a low-carbon economy.

- Greenhouse gas (GHG) emissions subject to assurance.

- Disclosures on climate-related metrics in notes to audited financial statements.

- Targets, goals and transition plans related to climate.

While these requirements represent an important step in the commitment to ESG principles, they also promise significantly more rigorous and strategic reporting obligations for many organizations.

Taking Charge of your Materiality Process

As ESG frameworks move from voluntary to compulsory, and regulations become more strategic, the concept of materiality has also expanded beyond the confines of its original definition to incorporate a broader ESG perspective. Until recently, materiality was viewed as a tick-box exercise with the narrow perspective of prioritizing ESG issues for the purpose of supporting sustainability reporting, with little to no regard for additional considerations. Today, organizations must meet the expectations of materiality as a strategic assessment, an integrated and structured process to identify, prioritize and monitor the dynamic ESG-issue universe driving decision-making. Regulators are also looking toward organizations and considering the financial impact of ESG issues on them, as well as the impact they have on the environment. We can see this in the EU’s Corporate Sustainability Reporting Directive (CSRD).

With unprecedented global disruption, such as the COVID-19 pandemic, increased global conflicts in locations such as Ukraine and a steady increase in the ferocity and cost of climate-related weather events, materiality assessments can no longer be isolated annual exercises that take place in silos across an organization. Instead, their strategic nature calls for a dynamic approach that uses automated methods to collect and analyze real-time data to prioritize and monitor emerging risks while attracting investors, meeting the needs of stakeholders and finding new opportunities for innovation and delivery of products and services to new markets.

This evolving landscape requires new ways of thinking about which data organizations should collect and why, as well as how they manage data. ESG compliance requires massive amounts of data from both inside and outside your organization. For example, the requirements for Scope 3 emissions from the SEC will necessitate that organizations can collect emissions data from their entire supply chain, from the producers of raw materials to post-consumer disposition of products.

Beyond data collection for compliance, the increasing importance of ESG and shifts in ownership bring new challenges to senior management and their board to understand what is truly material and strategic to their organization.

The days of managing tasks from spreadsheets and manually tracking trends are long over. Today, artificial intelligence (AI) and the Industrial Internet of Things (IIoT) are becoming the standard tools for managing the data needed for ESG compliance and readiness.

A Fully Managed Solution for ESG Reporting and Strategy: How Datamaran and Intelex Can Help

The partnership of Datamaran and Intelex equips organizations to meet evolving, data-intensive ESG demands, including for senior executives who are now required to weigh-in on those issues, as we’ve seen with the recent announcements from CEOs regarding the war in Ukraine.

Datamaran is the only ESG strategic solution on the market for C-Suite engagement, helping companies identify and monitor over 400 ESG risks on an ongoing basis. Trusted by blue-chip companies, it brings a data-driven business process for ESG risk and materiality analysis. As the first technology company to secure a patent on unstructured data analysis, it is also recognized as best practice by the European Financial Reporting Advisory Group (EFRAG) for ESG risk. Datamaran also continuously evolves its universe of ESG risk factors to ensure its AI remains relevant to the dynamic contexts in which organizations operate. As a result, organizational leadership can take ownership of ESG and focus on what really matters, make better business decisions and stay ahead of market developments with dynamic insights.

Intelex’s cloud-based solutions enable full life-cycle management of ESG strategy. It operationalizes ESG management workflows to enable organizations to collect reliable data, report investor-grade disclosures, communicate data-driven ESG stories, benchmark performance and manage risk. Intelex ESG Management automates the collection of ESG data, centralizes it and generates outputs for disclosure reporting, such as the Dow Jones Sustainability Indices (DJSI), CDP (formerly the Carbon Disclosure Project), Sustainability Accounting Standards Board (SASB) and the United Nations Guiding Principles Reporting Framework (UNGP).

The Intelex and Datamaran partnership provides data-backed support for ESG programs and initiatives, including assignment, due date, escalation and other ESG project management functions. Additional Intelex applications that support ESG include Environmental Aspects and Impacts for calculating risk exposure of environmental activities and Permits Management to centralize key permit information and make it available to all employees.

Intelex’s ehsAI solution uses AI and machine learning to help organizations transform the way they manage regulatory compliance. It quickly analyzes complex requirements such as permits, standards, regulations, consent decrees, policies, guidance documents and many other document types. The detailed and structured output highlights the important elements organizations need to know to meet their ESG obligations and provides the basis for what Intelex must monitor, measure and improve to facilitate compliance.

If the last two years have taught us anything, it’s that disruption is more than ever the order of the day, and that those dark clouds on the horizon might just be flocks of black swans for which every organization needs to prepare. By applying innovative solutions based on automation and AI, Intelex and Datamaran can help to create more responsible, resilient and sustainable organizations thanks to an informed ESG strategy backed by a unique set of external sources and a robust internal data management process.